Aura High Yield SME Fund

Aims to provide monthly income with 9-12% target returns from a diversified portfolio of debt securities, principally issued by lenders to SME businesses in Australia.

68.06%

Return since inception (cumulative)

9.89%

Since inception annualised

100%

Months of Outperformance

About Aura High Yield SME Fund

|

Key Fund Terms |

|

|

Investment Manager |

Aura Funds Management Pty Ltd |

|

Fund Term |

Open-ended |

|

Eligible Investors |

Wholesale clients only |

|

Minimum Investment |

A$500,000 or if you meet the criteria for wholesale and sophisticated investors as defined by the Corporations Act 2001, we will consider a minimum investment of A$100,000. |

|

Fund Yield |

9.0% - 12.0% p.a. (Net of Fees) |

|

Distribution Frequency* |

Monthly |

|

Minimum Investment Period |

1 month. Each Unit must be on issue for one month before it is eligible for redemption. A Unit which has not been on issue for one month is called a Redemption Locked Unit. |

|

Management Fees |

1.25% p.a. plus ordinary expenses |

|

Performance Fees |

20% of returns in excess of the benchmark |

|

Benchmark |

RBA Cash Rate + 5.0% p.a. |

*Monthly distributions are not guaranteed and are subject to the performance of the Fund and discretion of the Manager.

The Aura High Yield SME Fund (the Fund) is an open-ended unlisted fund that invests in online (non-bank) lenders specialising in providing finance to small-to-medium businesses (SME) in Australia.

The Fund offers monthly income, targeting 9% to 12% per annum return (net of management fees) with a low level of expected capital loss, provided that the Australian economy does not slow significantly. The Fund’s investments are backed by diversified pools of SME loans.

The Fund offers access to an attractive investment on a risk-return basis that captures the higher interest rate premium of SME loans.

Rated ‘Very Strong’ by Foresight Analytics

The Aura High Yield SME Fund has been graded by Foresight Analytics as Very Strong:

A Very Strong rating indicates a very strong level of confidence that the Fund can deliver a risk-adjusted return in line with its investment objectives at this stage of the growth of on-line lending in Australia. The investment manager’s support for this strategy is experienced and well-resourced. Designation as a COMPLEX Product indicates that the investment manager will seek to outperform their chosen specialist market sector, in this case, the Australian SME loan market.

This is a current rating and was issued in February 2022.

*Foresight Analytics was previously known as Australia Ratings and reflects a forward-looking opinion aimed to help investors identify funds or investment opportunities that are among “best in class”.

‘Commended’ by Evergreen Ratings

The Aura High Yield SME fund has received a Commended rating from Evergreen Ratings:

This is a Fund or Investment Product that has scored well across all areas of Evergreen Ratings’ research and analysis framework. As a result, Evergreen believes it has a high probability of achieving its investment objectives. It is likely to be appropriately designed, with appropriate fees and have sufficient, high quality systems and resources, including risk management and corporate governance, to ensure that it provides investors with an appropriate experience.

This is a current rating and was issued in November 2021. Read the Evergreen Ratings disclaimer.

Strong risk-adjusted returns

We continue to produce high returns with low volatility exhibiting minor correlation to public markets while prioritizing capital preservation.

Unique access

Aura High Yield SME fund gives investors access to a traditionally gated asset class – SME debt capital – by investing through leading online lending platforms in Australia.

Emerging alternative lending ecosystem

In 2017, Australia was the largest alternative finance market in APAC excluding China with 88% increase in alternative lending.

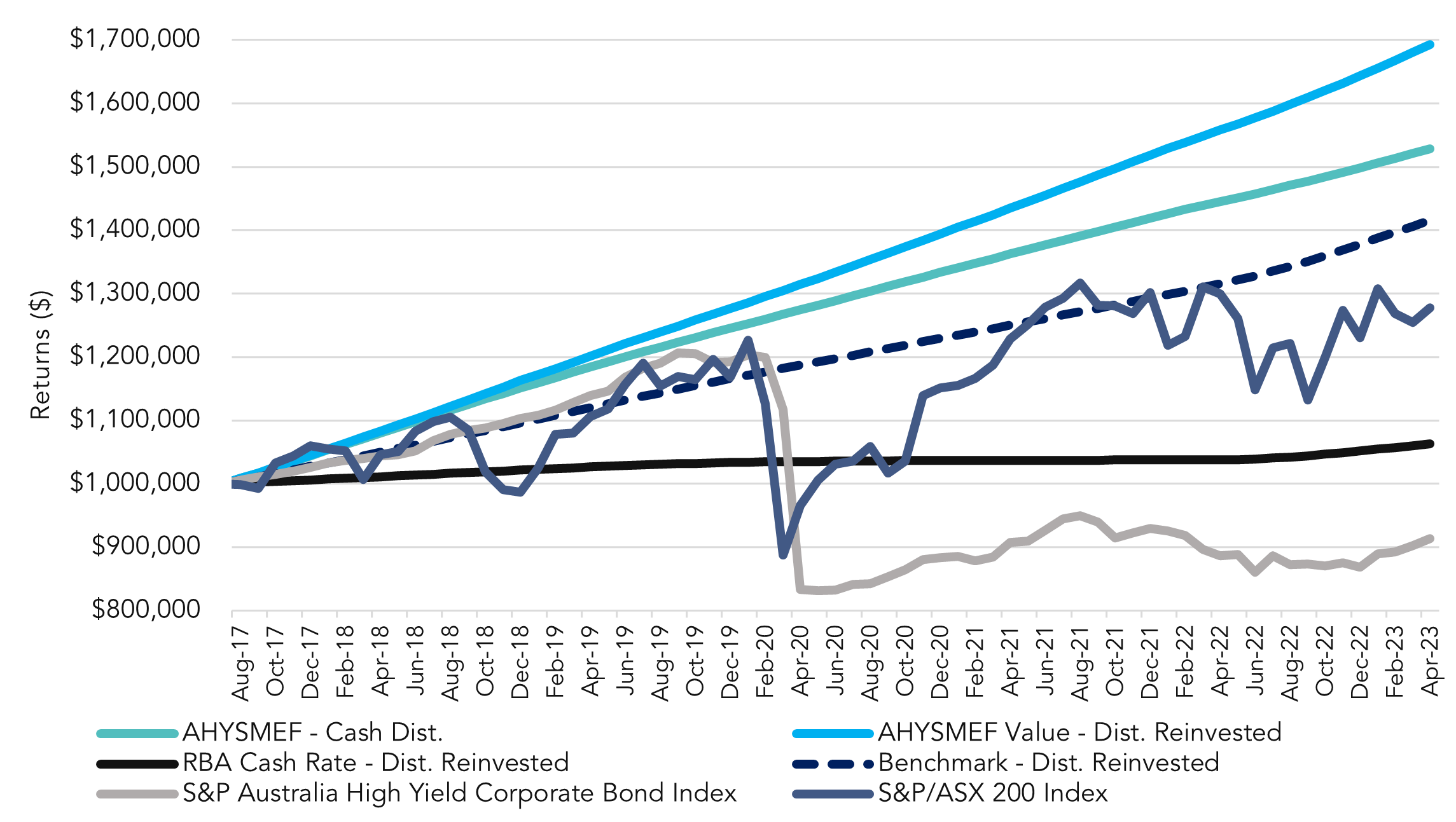

Portfolio returns overview*

The Fund had a net return after fees of 0.74% for the month of April’23, outperforming the benchmark return level of 0.71%.

The April’23 distribution is the 69th since the inception of the Fund.

Fund Performance (as at 30 April 2023)

Notes: Performance net of fees and expenses (1) Inception date 1-Aug-17, (2) RBA cash rate plus 5% p.a.

Returns assume reinvestment of all distributions. Past performance is not an indication of future performance.

Distribution History (%)

NAV (ex)

A$100K Investment in the Aura High Yield SME Fund

Source: ASX 200 (^AXJO) Adjusted Close Historical Data

Source: S&P Global - S&P Australia High Yield Corporate Bond Index Historical Data

*Past performance is not an indication of future performance

The Aura High Yield SME Fund Manager, Brett Craig, was featured by Livewire, discussing the emergence of SME debt capital as an asset class and its potential attractiveness for wholesale income investors seeking stable cashflow.

As Fund Manager, Brett aims to provide stable monthly income from a diversified portfolio of debt securities, principally issued by lenders to SME businesses in Australia.

Video One: In this video, Brett explains the opportunity in

providing debt financing to SME lenders and why there is

a funding gap for SME’s

Video Two: Brett explains how his process has adapted to the changing environment, what government stimulus has meant for SMEs and what to expect when measures like JobKeeper are wound back.

Video Three: Here, Brett delves a bit deeper into his investing strategy. Whereas private credit arrangements are typically made with underlying borrowers, Aura provides facilities to non-banks who then lend money to small businesses.

Weekly Insights

The Aura High Yield SME Fund aims to provide investors with stable and consistent returns which are uncorrelated with public markets through the purchasing of notes in Australian SME lender warehouse funding facilities. Due to the fund’s underlying exposure to Australian SMEs and the adverse impacts the COVID-19 pandemic has had on the sector, these reports aim to provide current and prospective investors with regular updates on relative news and portfolio commentary.

To learn more, please visit our News & Insights.

Thank you for your interest in our Aura High Yield SME fund.

Aura Group Funds Management has a minimum investment A$500,000. If you meet the criteria for wholesale and sophisticated investors as defined by the Corporations Act 2001, we will consider a minimum investment of A$100,000.

Contact us

Please fill in the form or contact us for more information.

Email: info@aura.co

DISCLOSURE: This page is provided to wholesale and sophisticated investors for information purposes only by Aura Capital Pty Ltd ABN 48 143 700 887 AFSL No. 366 230 (“Aura”). Aura Funds Management Pty Ltd ABN 96 607 158 814 is the Trustee of the Fund mentioned and is an Authorised Representative No. 1233893 of Aura.

Any financial product advice given is of a general nature only. The information has been provided without taking into account the investment objectives, financial situation or needs of any particular investor. Therefore, before acting on the information contained on this website you should seek professional advice and consider whether the information is appropriate in light of your objectives, financial situation, and needs. Aura does not guarantee the performance of its funds, the repayment of any capital or any rate of return. Investing in any financial product is subject to investment risk including possible loss. Past performance is not a reliable indicator of future performance. Information in this report is based on the information provided to Aura by third parties that may not have been verified. Aura believes that the information is reliable but does not guarantee its accuracy or completeness. Aura is not able to give tax advice and accordingly, investors should obtain independent advice from an accountant and/or lawyer before making any decision based on the tax treatment of its investors. You must read the Fund Fact Sheet or Information Memorandum and seek professional advice before making a decision to invest in any of the funds.